Description

Company Summary

| Tickmill Review Summary in 10 Points | |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Market Instruments | Forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options |

| Demo Account | Available |

| Copy Trading | Yes |

| Leverage | 1:1-1:500 |

| Spread from | 0.0 pips |

| Trading Platforms | MT4, MT5, Tickmill Mobile App |

| Minimum deposit | $/€/£/R100 |

| Customer Support | Live chat, phone, email, social media, FAQ |

| Bonus | A $30 welcome bonus |

What is Tickmill?

Tickmill, the trading name of Tickmill Group of companies, is a regulated global forex and CFD brokerage company established in 2014, headquartered in London, UK. Tickmill offers trading in forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options, and provides clients with two choices of trading accounts, which are the Classic account and the Raw account. Tickmill also offers MetaTrader4/5 and proprietry mobile app platforms for trading, as well as a range of trading tools and educational resources.

What Type of Broker is Tickmill?

Tickmill operates as a no dealing desk (NDD) broker. This means that the broker doesn’t take the other side of clients’ trades but instead passes them on to liquidity providers. Tickmill offers both retail and institutional trading services and provides access to a wide range of financial instruments. They also offer various trading platforms and account types to suit different trading styles and needs.

Pros & Cons

| Pros | Cons |

| • Regulated by multiple reputable authorities | • Regional restrictions |

| • Tight spreads and low commissions | • No 24/7 customer support |

| • Wide range of trading platforms | |

| • Access to a variety of markets | |

| • Negative balance protection | |

| • Multiple account types to suit different traders | |

| • Rich educational resources |

Tickmill is a reputable and reliable broker that offers competitive trading conditions and a wide range of trading instruments. Its low spreads and fees, multiple account types, various trading platforms and rich tarding tools and educational resources are attractive to traders of all levels.

However, Tickmill is not available in all countries, and their customer support operates within specific working hours. It’s important for potential users to verify these details ahead of registration.

Nonetheless, its overall transparency, security, and quality of service make it a popular choice among traders worldwide.

Is Tickmill Safe?

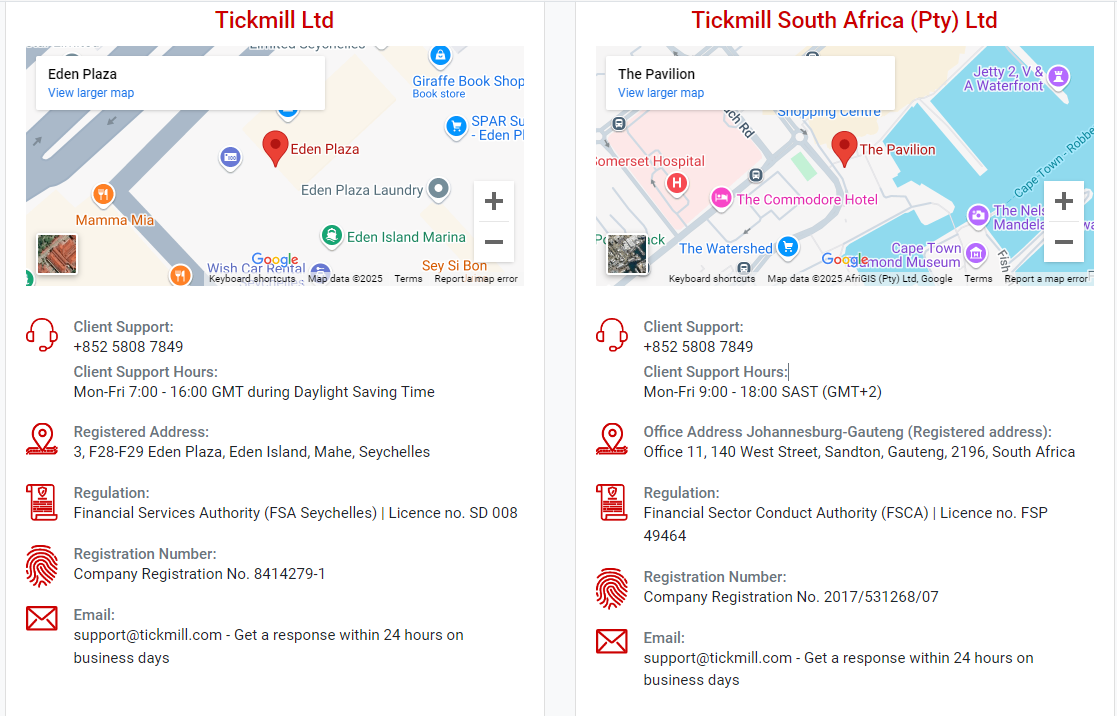

Tickmill is a regulated broker that holds licenses from respected financial authorities, including Financial Conduct Authority (FCA, No. 717270), Cyprus Securities and Exchange Commission (CYSEC, No. 278/15), Financial Sector Conduct Authority (FSCA, No. 49464), and Labuan Financial Services Authority (LFSA, No. MB/18/0028).

This indicates that it complies with the required regulations and standards to provide financial services to their clients. Additionally, Tickmill has been in operation since 2014 and has gained a good reputation in the industry, which suggests that they are a legitimate broker.

How are You Protected?

Tickmill uses segregated accounts to keep client funds separate from its operational funds, which provides an additional layer of protection in case of the company’s insolvency.

Tickmill also uses advanced security protocols and encryption technology to protect clients’ personal and financial information.

The company also offers negative balance protection, which ensures that clients cannot lose more than their account balance, and it has a compensation scheme in place that can provide additional protection to eligible clients in case of the company’s insolvency.

More details can be found in the table below:

| Protection Measure | Detail |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Segregated Accounts | Client funds are held in segregated accounts, separated from the company’s operating funds |

| Negative Balance Protection | Ensuring clients’ accounts cannot go below zero |

| Investor Compensation Scheme | Clients are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person in the event of the broker’s insolvency |

| SSL Encryption | Protecting clients’ personal and financial information from unauthorized access |

| Two-Factor Authentication | To add an extra layer of security to clients’ accounts |

| Anti-Money Laundering Policy | To prevent money laundering and other illegal activities |

| Privacy Policy | Ensuring clients’ personal information is kept confidential and used only for legitimate purposes |

Note that this table is not exhaustive and there may be other protections or security measures in place at Tickmill.

Our Conclusion on Tickmill Reliability:

Based on the information available, Tickmill appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years, and has received positive reviews from many customers.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

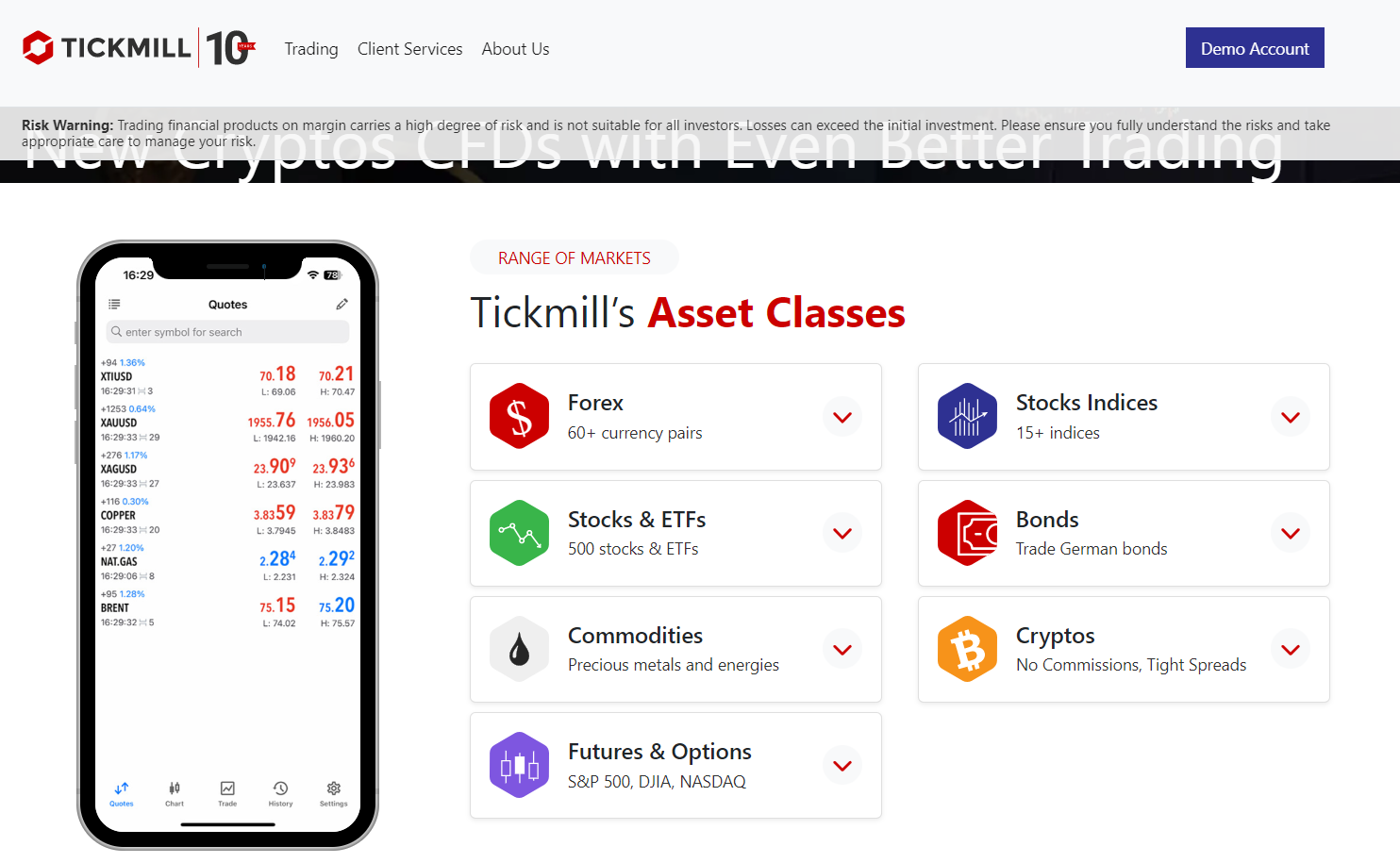

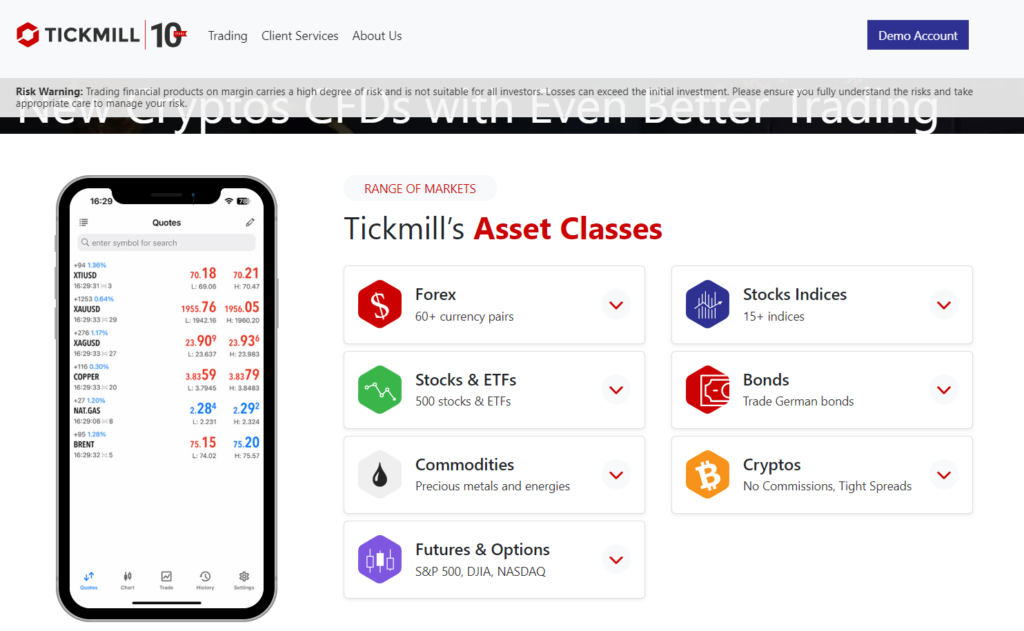

Market Instruments

Tickmill is a comprehensive trading platform that offers 180+ financial instruments. Their offerings include over 60 forex currency pairs, more than 15 stock indices, 500+ stocks and ETFs, bonds, various commodities including precious metals and energies, cryptocurrencies, as well as futures and options such as S&P 500, DJIA, and NASDAQ. These options provide users with the flexibility to diversify their investment portfolio.

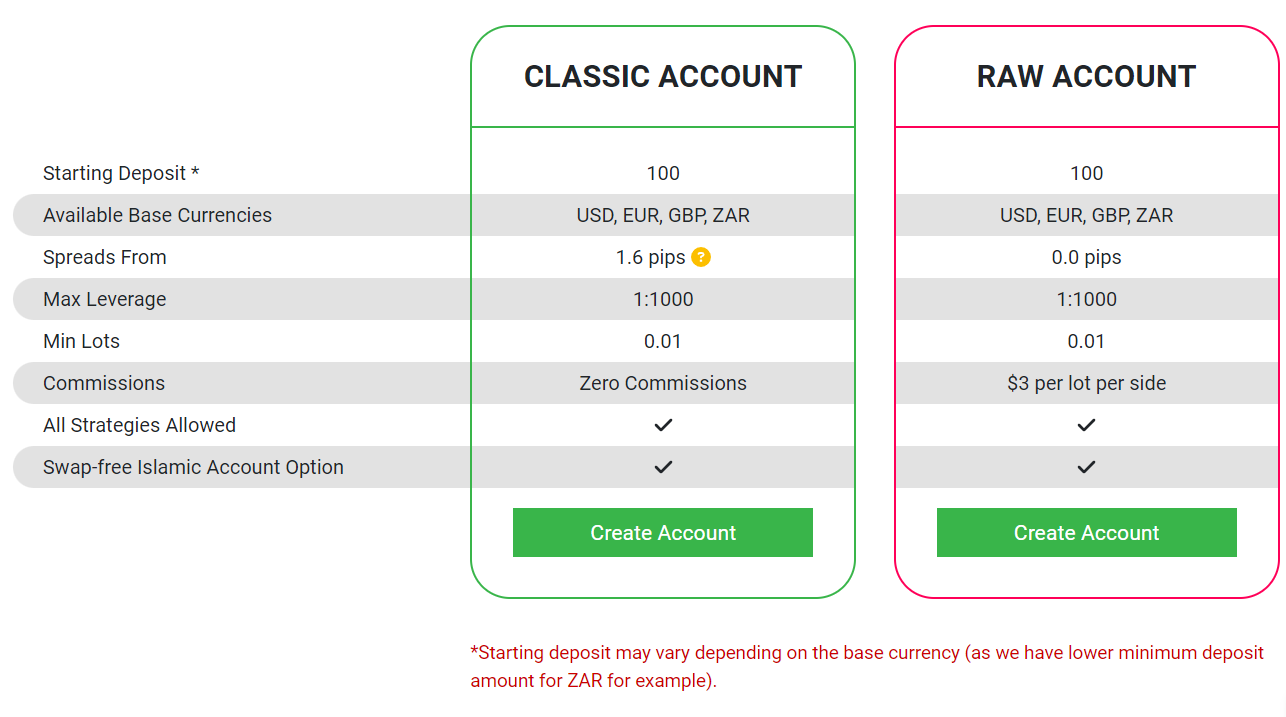

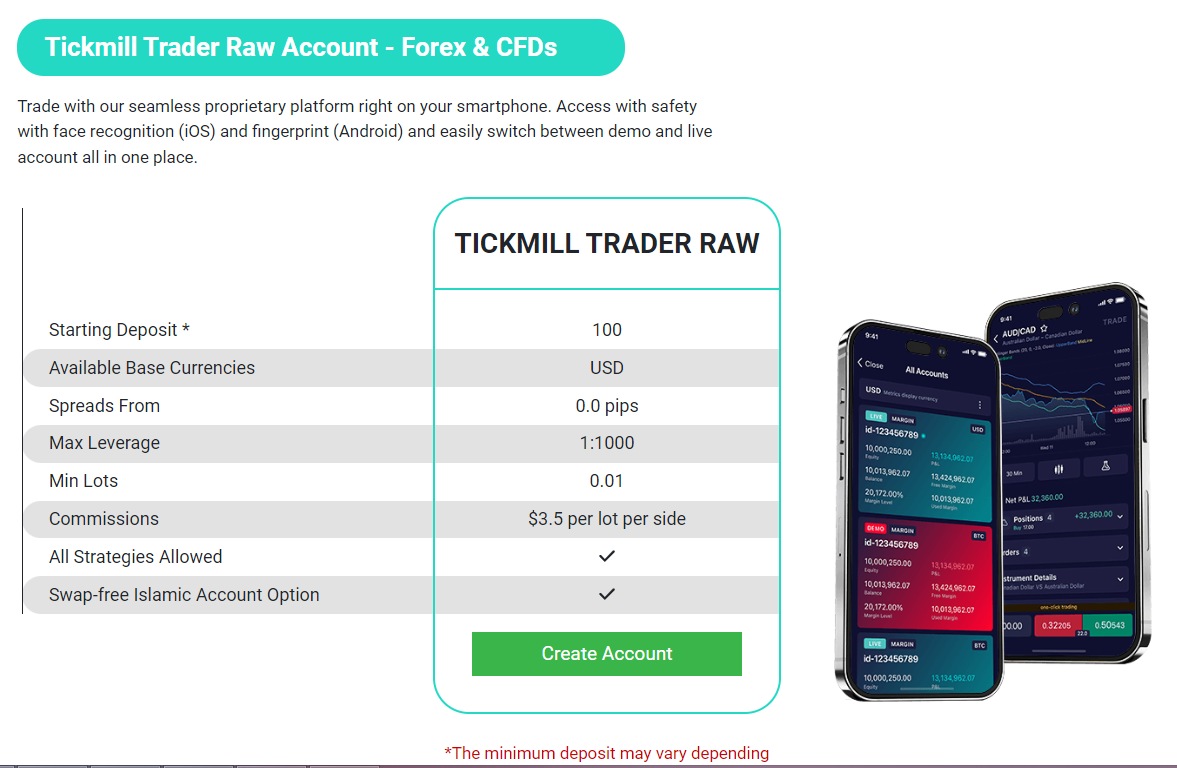

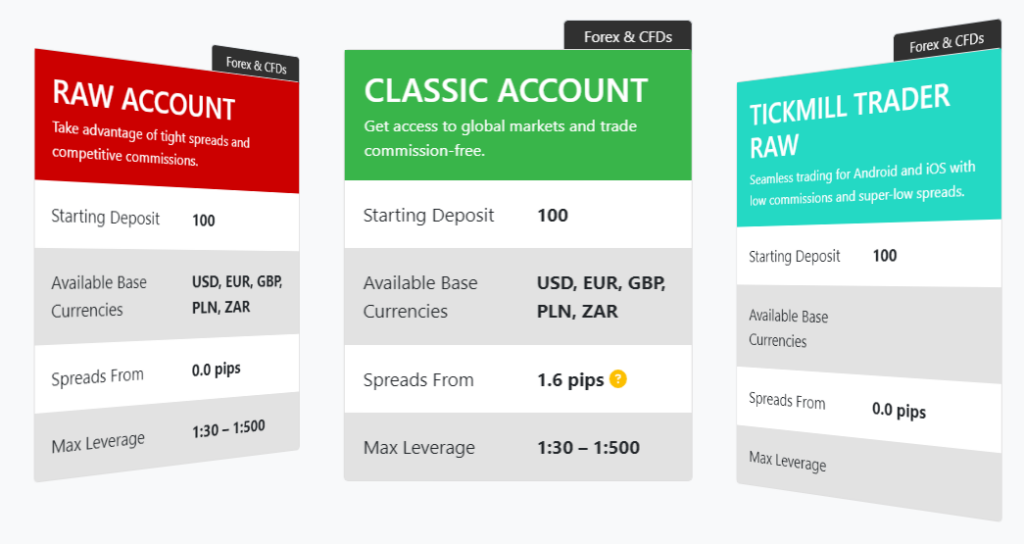

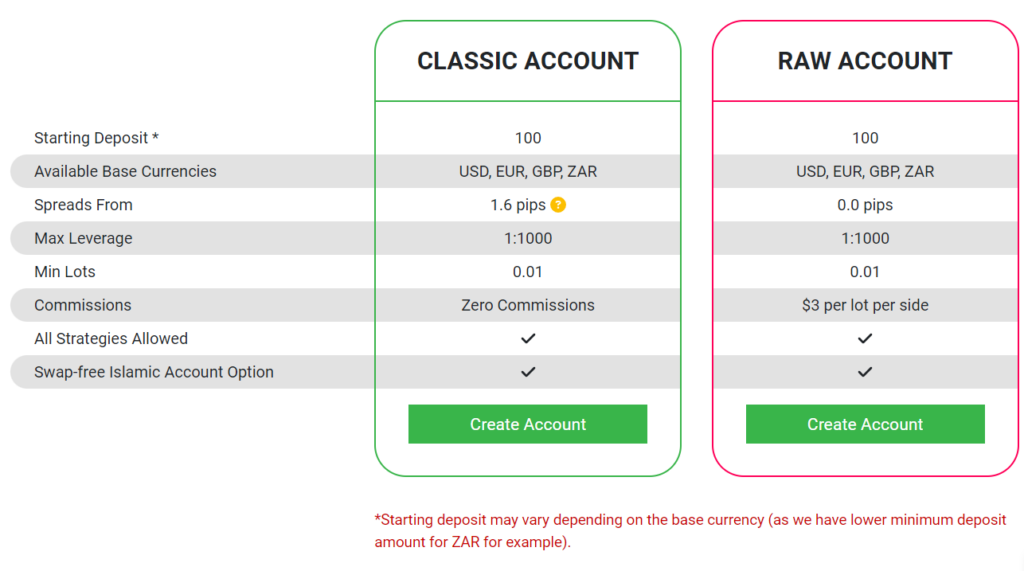

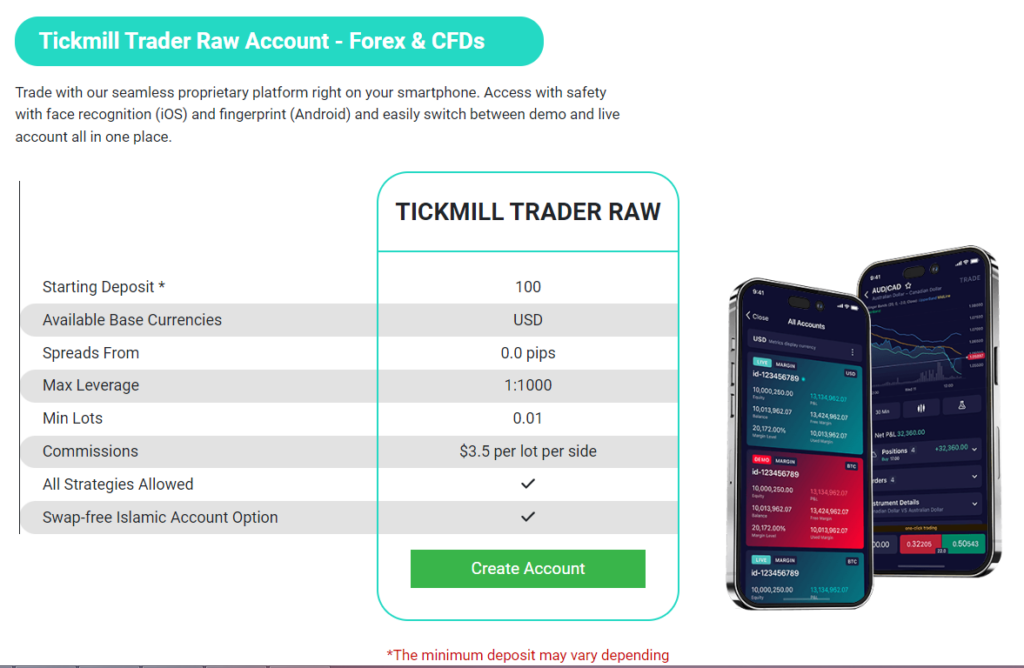

Account Types

Two trading account options available with TickMill: the Classic Account and the Raw Account. The Classic Account requires $100, featuring spreads starting from 1.6 pips, a maximum leverage of 1:1000, a minimum lot size of 0.01, and zero commissions. Available base currencies include USD, EUR, GBP, and ZAR.The Raw Account, on the other hand, provides raw spreads from 0.0 pips with a commission of $3 per lot per side, while maintaining the same minimum deposit, leverage, minimum lot size, and base currency options as the Classic Account. Both account types allow all trading strategies and offer a swap-free Islamic account option.

All account types at Tickmill offer access to the same range of trading instruments. Additionally, all accounts can be opened as Islamic accounts, which are swap-free accounts for traders who follow Sharia law.

Prior to committing to various live trading accounts, clients have the option to explore Go Markets’ offerings through the provided demo accounts, allowing them to familiarize themselves with the trading environment before engaging in real trading activities.

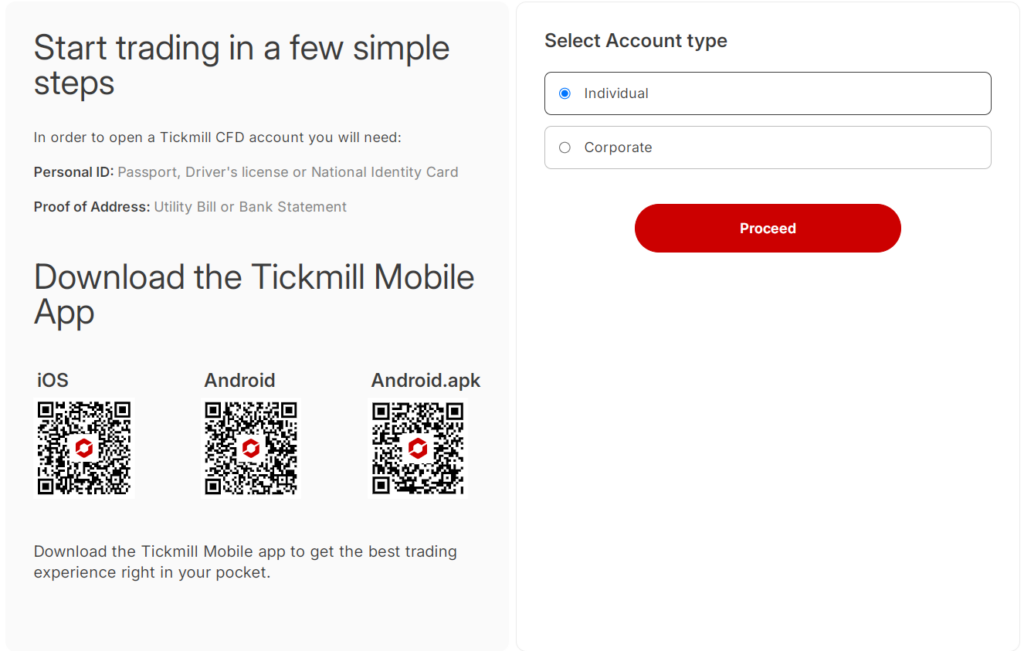

How to Open an Account?

Step 1: Register

Click on ‘Create account’. Enter your personal details and check your email for verification.

Submit your Proof of Identity and Proof of Address to complete registration.

Step 3: Fund and Choose Platform

Open a trading account, deposit to your Tickmill wallet, transfer funds from your Tickmill wallet to your live trading account and download the trading platform of your choice to start trading.

Leverage

Tickmill offers flexible leverage ranging from 1:1 to 1:1000, depending on the account type and the instrument traded. The maximum leverage available for forex trading is 1:1000. For stock indices, commodities and bonds, the maximum leverage is 1:100. For cryptocurrencies, the maximum leverage is 1:200.

Bear in mind that higher leverage levels increase the potential profits but also increase the potential losses, so it’s important to use leverage carefully and manage risk appropriately.

Spreads & Commissions

The Classic Account provides spreads starting from 1.6 pips with no commissions charged, making it a suitable choice for traders seeking competitive spreads without additional trading fees. Alternatively, the Raw Account caters to those preferring raw spreads from 0.0 pips, accompanied by a commission of $3 per lot per side.

| Account Types | Spread | Commission |

| Classic Account | From 1.6 pips | No commissions charged |

| Raw Account | From 0.0 pips | $3 per lot per side |

Bonuses Offered

TickMill extends a genuine welcome bonus of $30 to new traders, manifested as an automatic complimentary deposit of $30 into the Welcome Account upon account opening. However, the Welcome Account is denominated exclusively in US Dollars (USD).

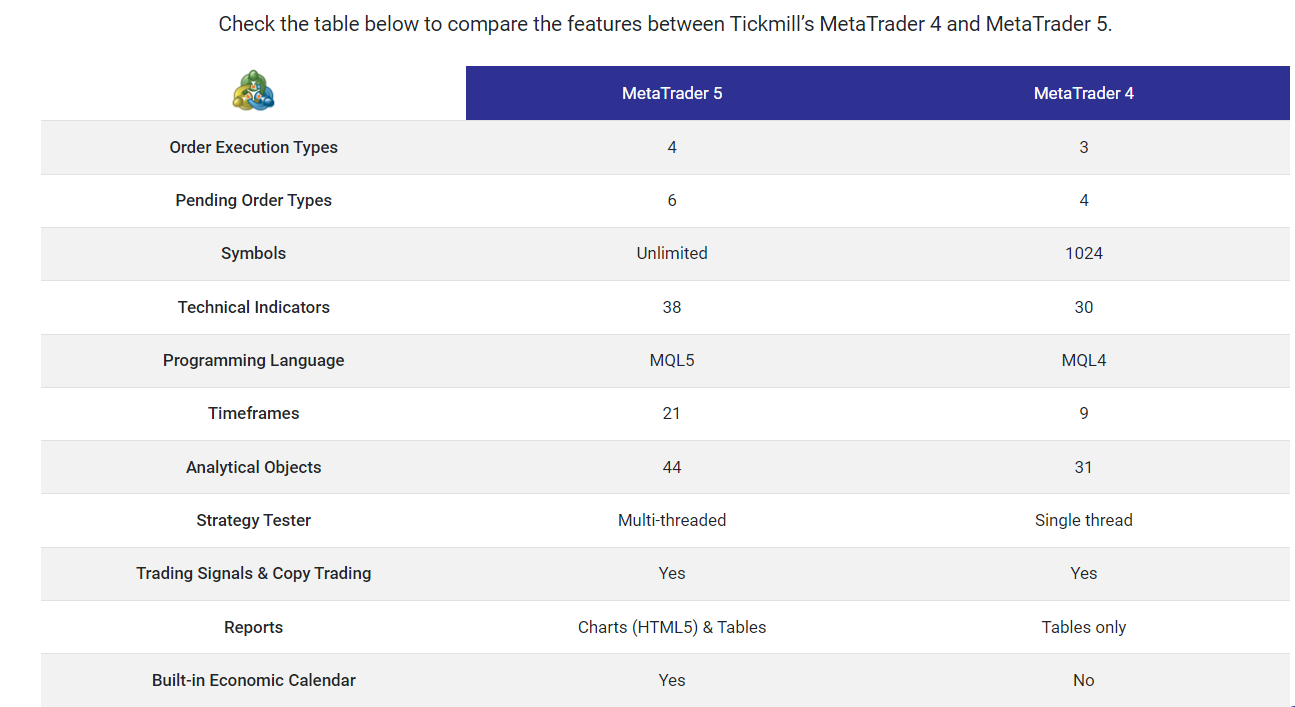

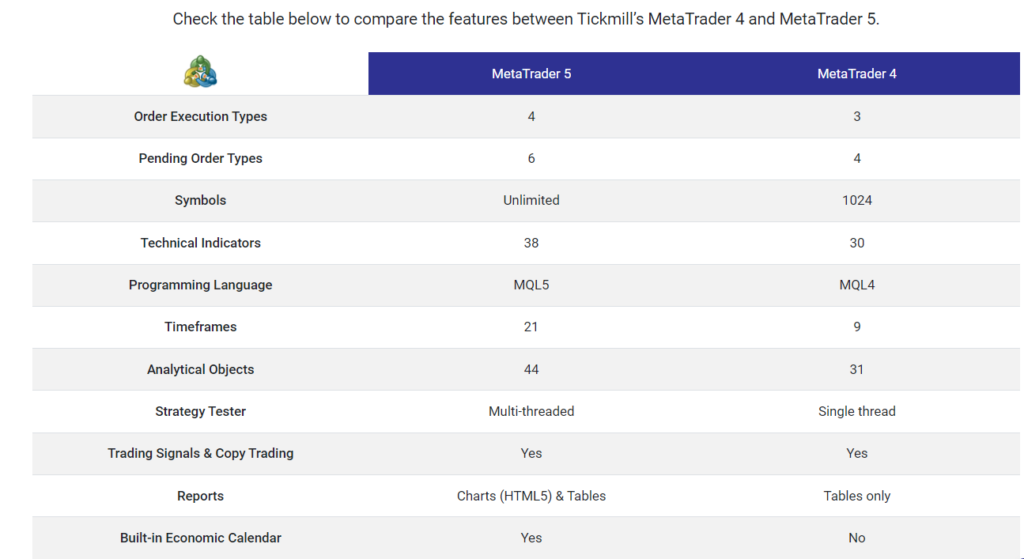

Trading Platforms

Tickmill offers several trading platforms for its clients, including:

- MetaTrader 4 (MT4): This is a popular trading platform among forex traders due to its advanced charting capabilities, numerous technical indicators, and ability to run automated trading strategies.

- MetaTrader 5 (MT5): This is an upgraded version of MT4, offering additional features such as more timeframes, depth of market, and the ability to trade other instruments such as stocks and commodities.

- Tickmill Mobile App: This is a proprietary platform developed by Tickmill, offering a user-friendly interface, advanced charting tools, and the ability to trade directly from charts.

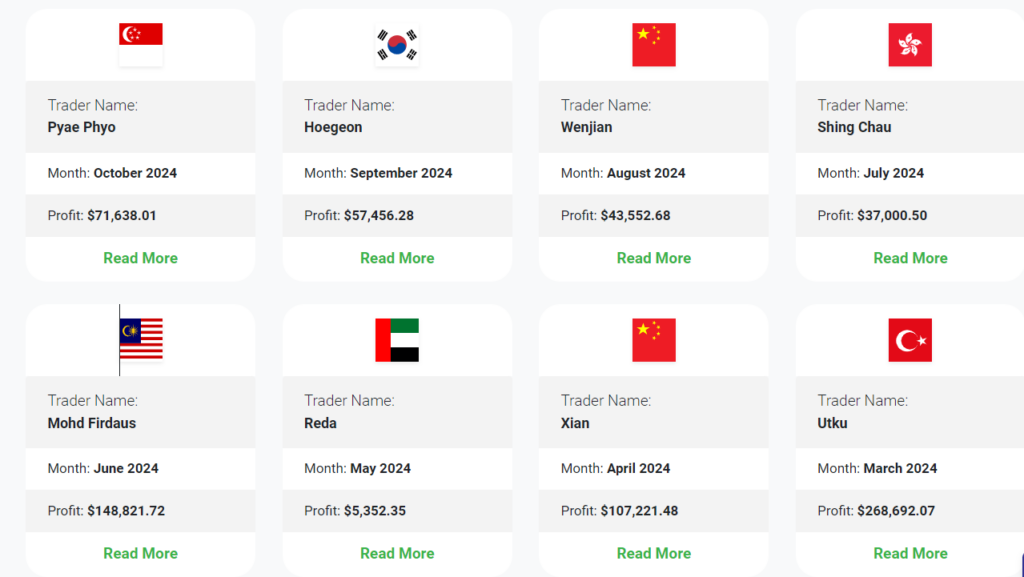

Copy Trading

Tickmill offers copy trading features. This allows less experienced traders to copy the trades of more experienced traders, potentially increasing their chances of making profitable trades. It’s a strategy often used by new traders or those looking to diversify their trading. You can copy top traders on Tickmill’s website.

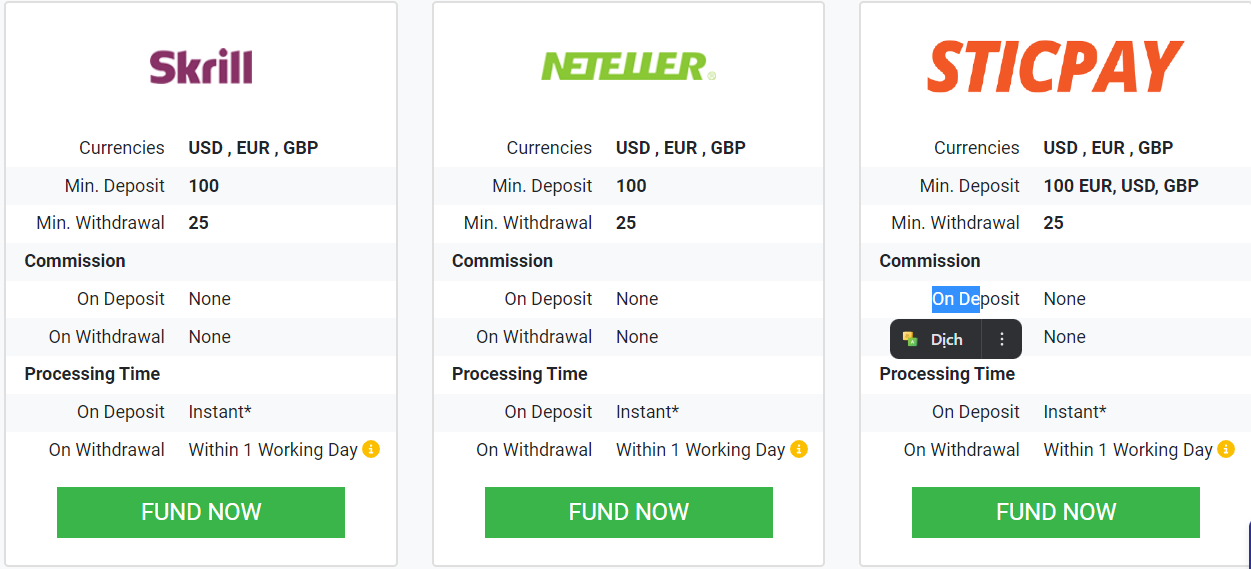

Deposits & Withdrawals

Another crucial factor while selecting a Forex broker is to see how to transfer money to or from your trading account. Obviously, regulated brokers adhere to best practices and are regulated by their authority in terms of money management.

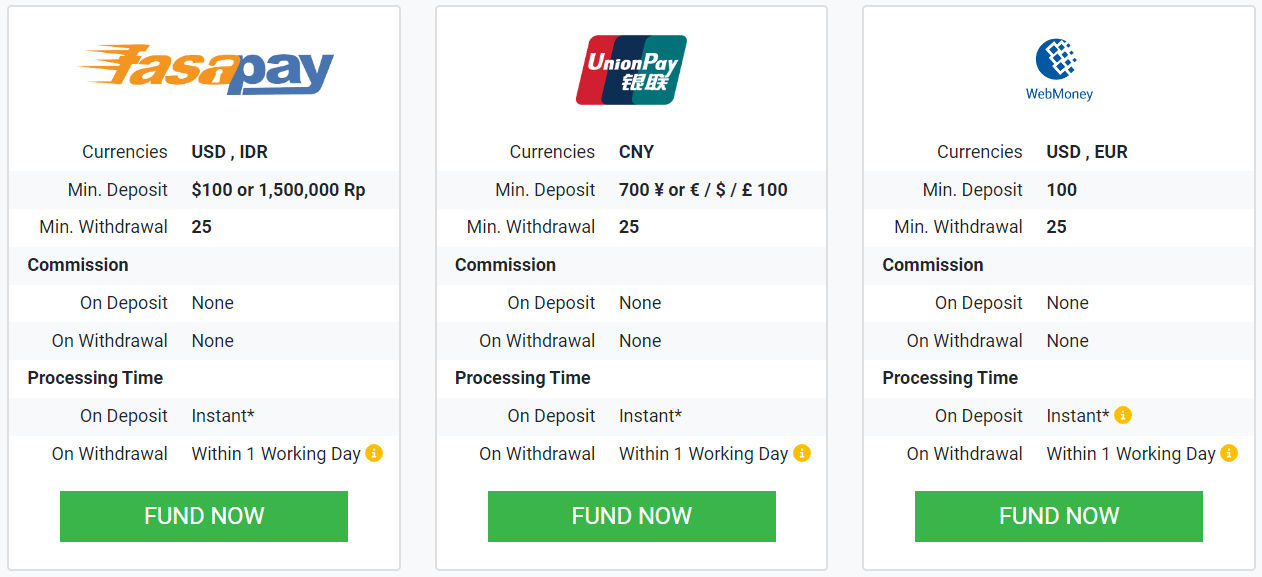

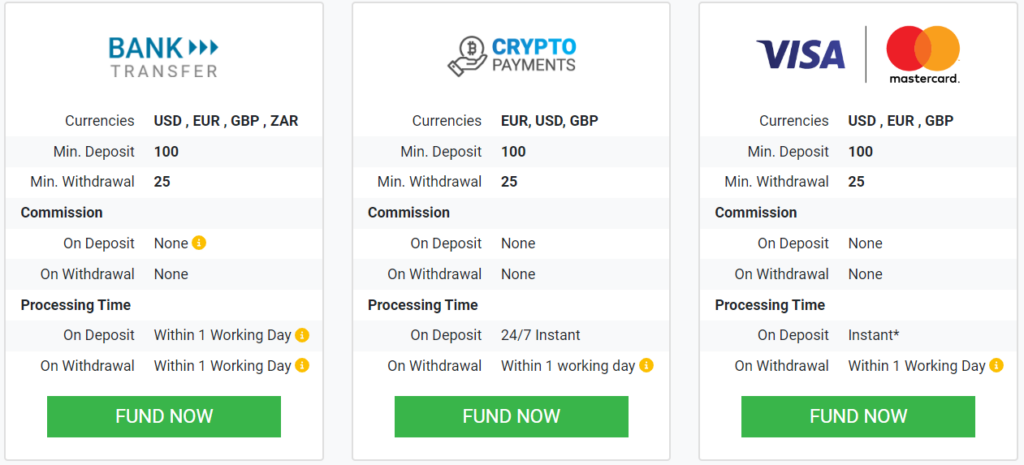

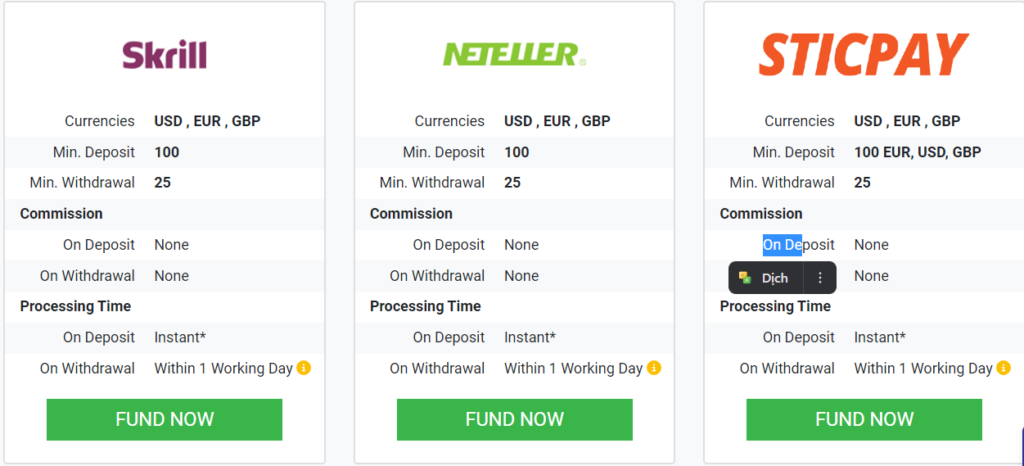

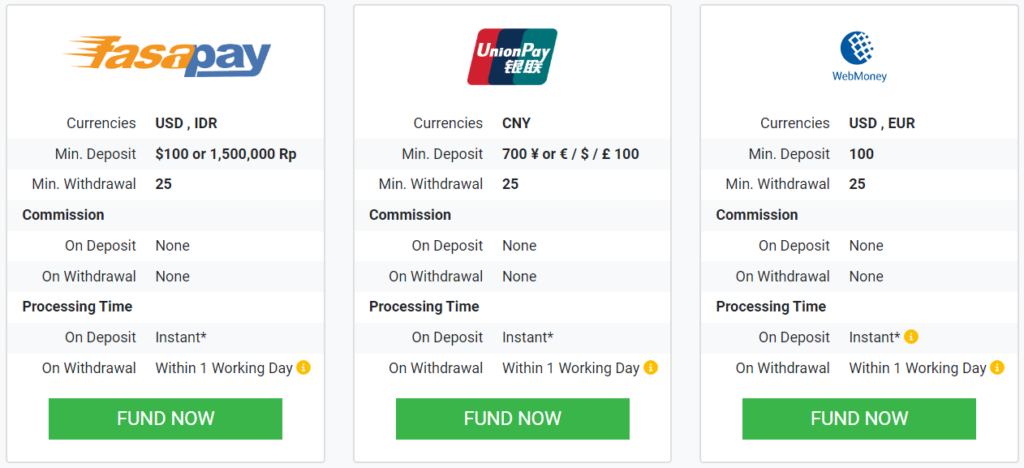

Tickmill offers various deposit and withdrawal methods to its clients. Here are the most common methods:

- Bank wire transfer

- Crypto payments

- Credit/debit cards (Visa, Mastercard)

- Skrill

- Neteller

- Sticpay

- FasaPay

- Union Pay

- Web Money

Minimum deposit requirement

As we have mentioned before, the minimum deposit with Tickmill is $/€/£/R100 for the Classic and Pro accounts, while the higher-grade VIP accounts will require more money of up to $/€/£/R50,000, as designed for traders with experience.

Tickmill minimum deposit vs other brokers

| Tickmill | Most other | |

| Minimum Deposit | $/€/£/R100 | $/€/£100 |

Tickmill Money Withdrawal

To withdraw funds from your Tickmill account, you need to follow these steps:

Step 1: Log in to your Tickmill Client Area.

Step 2: Select the “Withdraw Funds” option under the “Deposit & Withdraw” tab.

Step 3: Choose the payment method you want to use for withdrawal.

Step 4: Enter the amount you wish to withdraw.

Step 5: Fill out any necessary information related to your selected payment method.

Step 6: Submit your withdrawal request.

Once your withdrawal request is approved, the funds will be transferred to your selected payment method.

Fees

Tickmill does not charge deposit and withdrawal fees, but fees may be incurred by the payment method used. Also, inactivity fees of $10 per monthare charged on accounts that have been inactive for over six consecutive months.

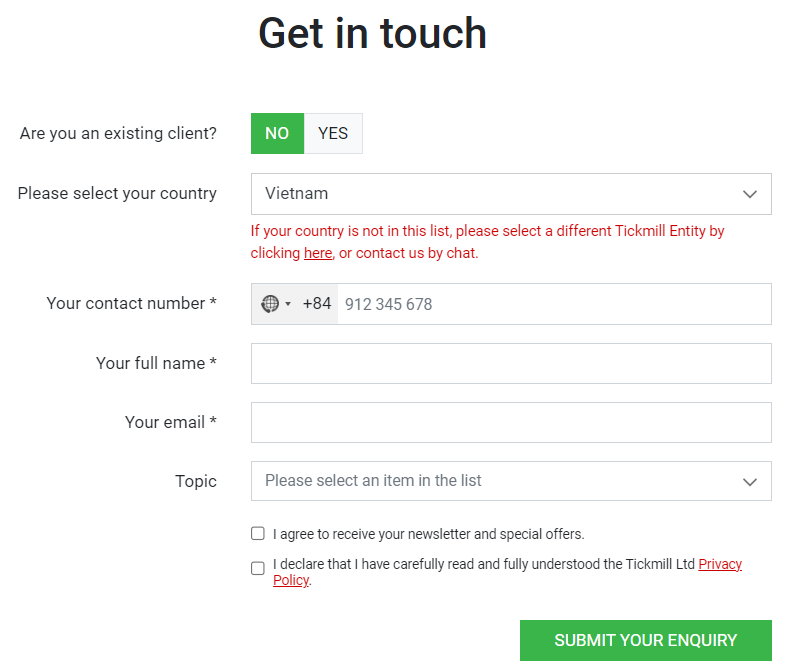

Customer Service

Tickmill offers customer support services to its clients via various channels, including email, phone, live chat, and social media. The broker has a multilingual customer support team that provides assistance in several languages, including English, Spanish, Italian, Chinese, and more.

Educational Resources

Tickmill is committed to providing a comprehensive education for traders at every level of experience. Their educational resources include webinars and seminars conducted by industry professionals, geared to enhance their clients’ trading knowledge and skills. They offer extensive reading material such as eBooks, articles and infographics that cover a wide range of trading topics.

Tickmill also accommodates a detailed forex glossary for quick reference. They provide insights into market analysis both from a fundamental and technical perspective, offering daily market insights that help traders navigate the financial markets. This array of educational tools is designed to support traders in making informed trading decisions.

Conclusion

Overall, Tickmill is a good option for traders who are looking for a reliable and transparent broker with competitive trading conditions. Some of the advantages of Tickmill include its strong regulatory framework, low trading fees, a wide range of trading instruments, multiple trading platforms, and excellent customer support.

It is particularly suitable for experienced traders who are looking for a broker that provides access to a variety of markets and trading instruments, as well as competitive trading conditions. Additionally, Tickmill’s demo account allows traders to test their strategies and trading skills before investing real money.

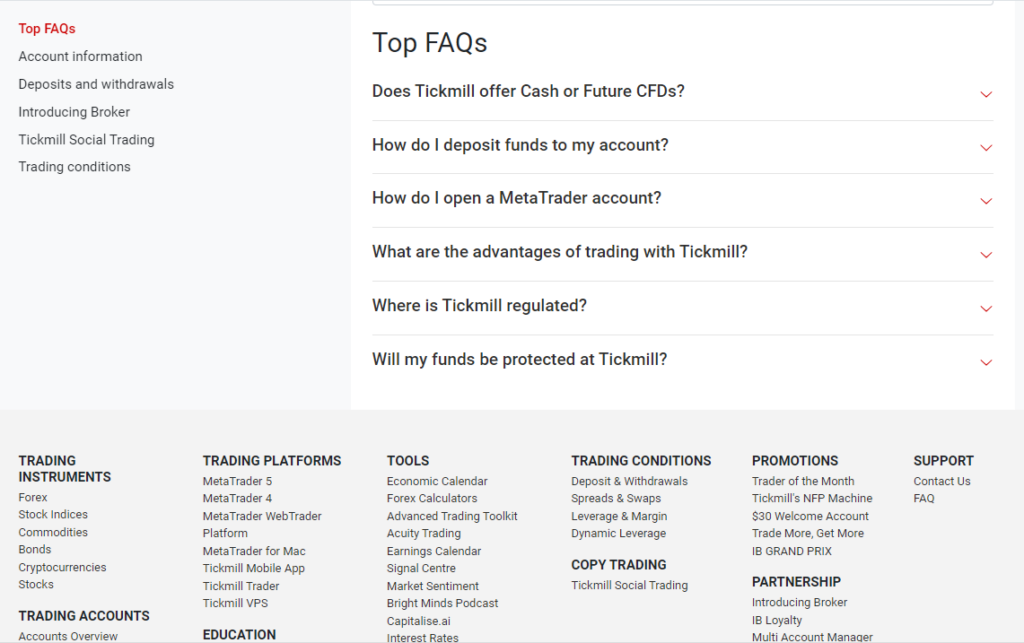

Frequently Asked Questions (FAQs)

Is Go Markets good for beginners ?

GO Markets can be a suitable choice for beginner traders, as it offers user-friendly trading platforms, comprehensive educational resources, and various account types to cater to different needs and experience levels.

What trading platforms does GO Markets offer?

GO Markets provides access to a suite of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, as well as cTrader, MetaTrader Copy Trader, cTrader Copy Trading, and a web-based trading platform called GO WebTrader.

Does GO Markets charge any deposit or withdrawal fees?

Generally, GO Markets does not charge any internal fees for deposits or withdrawals.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company’s services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Reviewed by 1000 users

-

- by: Tan Nhan

- February 13, 2025 2:46 pm

Hãy cẩn thận với nhà môi giới này. Họ nói “Tất cả các chiến lược đều được khuyến khích”. Tuy nhiên, khi bạn cố gắng sửa đổi đơn đặt hàng của mình một vài lần, họ sẽ khóa đơn đặt hàng của bạn.

-

- by: Lann Hong

- February 13, 2025 2:39 pm

tôi thích việc rút tiền nhanh nhất của họ. Nhận tiền của tôi vào ví của tôi trong vòng tối đa 2 giờ!

-

- by: Lien Hoai

- February 13, 2025 2:29 pm

Tôi đang chạy EA của mình trên 3 nhà môi giới để so sánh sự khác biệt; Tôi nhận thấy rằng ở các mức đột phá, Tickmill đang tăng mức chênh lệch của họ với hơn 20 điểm và giá đang tăng và giảm; đồng thời, mức chênh lệch với IC-Markets và Darwinex là bình thường và ổn định, dẫn đến thua lỗ trên Tickmill, trong khi những người khác dẫn đến lợi nhuận.

-

- by: Tai Khien

- February 13, 2025 2:22 pm

Tôi đã làm việc với họ được khoảng 6 tháng. Trong quá trình giao dịch, tôi không gặp bất kỳ vấn đề nào. Fills, chốt lời, cắt lỗ khá tốt. Chênh lệch thuận lợi.

-

- by: Khiem Nhuong

- February 13, 2025 2:13 pm

Tôi có tài khoản cổ điển với họ nhưng vẫn chưa sử dụng nó để giao dịch vì tôi vẫn không chắc chắn về mức chênh lệch của họ (đối với tài khoản cổ điển, mức chênh lệch hơi rộng và không chắc chắn về mức trượt giá của họ) và loại môi giới của họ (một số nói rằng họ là ECN, trong khi những người khác nói rằng họ là MM).

-

- by: Mon Cong

- February 13, 2025 1:58 pm

Điều tôi thích nhất ở Tickmill là tốc độ và độ ổn định của nền tảng của họ. Chúng cung cấp mức chênh lệch cạnh tranh và khớp lệnh chính xác, lý tưởng cho các chiến lược mở rộng quy mô, trong ngày và xoay vòng. Ngoài ra, sự đa dạng của các công cụ tài chính có sẵn cho phép tôi dễ dàng đa dạng hóa các giao dịch của mình.

-

- by: Loi Nhuan

- February 13, 2025 9:42 am

Nền tảng của Tickmill còn thiếu nhiều công cụ phân tích kỹ thuật so với một số sàn khác

-

- by: Han Chang

- February 13, 2025 9:38 am

Giao dịch bị hạn chế ở một số khu vực mà không rõ lí do

-

- by: Bong Nhung

- February 13, 2025 9:32 am

Tickmill hỗ trợ nhiều nền tảng khác nhau như MetaTrader, CQG, và AgenaTrader

-

- by: Bien Nhien

- February 13, 2025 9:25 am

Là một người mới bắt đầu, tôi thấy Tickmill rất hữu ích

-

- by: Hanh le

- February 13, 2025 9:12 am

Tôi vẫn đang chờ hoàn lại tiền :(((

-

- by: Thong Mai

- February 13, 2025 9:08 am

Hoàn toàn là nhà môi giới .. Tôi đã được mở một acc ticmill với email của tôi và tôi gửi hộ chiếu của mình nhưng họ từ chối hộ chiếu của tôi và chặn acc của tôi

-

- by: Den Luc

- February 13, 2025 9:03 am

Chênh lệch thấp, khớp lệnh nhanh, nạp/rút tiền nhanh. Cho đến nay Tickmill là nhà môi giới TỐT NHẤT mà tôi đã thử trong suốt thời gian qua.

-

- by: Trai Hanh

- February 13, 2025 8:12 am

Lúc đầu tôi thích nó nhưng bất cứ khi nào tôi rút tiền một chút đến thường xuyên, có vẻ như tốc độ tích tắc giá chậm lại đáng kể.

-

- by: Phan Ung

- February 13, 2025 8:04 am

chênh lệch siêu thấp ,khớp lệnh nhanh

-

- by: Khanh Hong

- February 13, 2025 7:55 am

Trong trường hợp của tôi, nhà môi giới này tốt nhất về độ tin cậy, tốc độ vượt trội, tài khoản quyền chọn chênh lệch bằng không, giải thưởng, rút tiền và gửi tiền

-

- by: Thanh Sơn

- February 13, 2025 7:52 am

Tôi không nghĩ rằng đây là một nhà môi giới nhỏ. Mọi thứ đều là hàng đầu và hỗ trợ khách hàng của họ khá hữu ích.

Tôi muốn giới thiệu nhà môi giới này vì tôi thấy nó đáng tin cậy và an toàn. -

- by: Luu Tan

- February 13, 2025 7:45 am

vui lòng thêm nền tảng MT5

-

- by: Gia Chong

- February 13, 2025 7:38 am

nhà môi giới rất tốt … không thực hiện báo giá lại .. chênh lệch rất thấp.

-

- by: Nguoi Ta

- February 13, 2025 7:31 am

Tất cả đều tuyệt vời cho đến nay. Tiền gửi được thanh toán trong ngày, hỗ trợ khách hàng tuyệt vời và nhanh chóng trong khi trải nghiệm giao dịch quan trọng nhất là tối cao vì chênh lệch thấp

Leave feedback about this